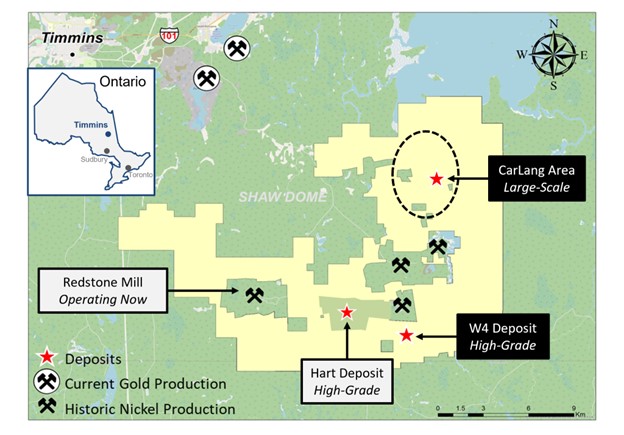

The Shaw Dome has over 30,000 hectares to explore and >100 km of additional favourable strike length. The Shaw Dome includes the High-Grade W4 Deposit- with a Resource which defined 2.0M tonnes @ 0.98% Ni for 43.3M lbs of Class 1 Nickel across Measured, Indicated and Inferred and the Large-Scale CarLang Area with more than 10km of mineralization and where the first 20% contains the A Zone- with a Resource which defined 1.0B tonnes @ 0.24% Ni for 5.3B lbs of Class 1 Nickel across Indicated and Inferred.

The Company is focused on a 2-track strategy:

Track 1- to produce High-Grade Clean Nickel™ (starting with W4) and

Track 2- an integrated Carbon Capture & Storage project with Large-Scale Clean Nickel™ production (starting with CarLang).

Airborne geophysics have been flown over the entire property and more than 20 separate clusters of airborne EM anomalies were identified.

3 Key Differentiators to set the Shaw Dome apart

Massive Potential

W4 mineralization entends up and down trend and is open at depth. The full package is over 30,000 hectares with more than 100km of strike to explore.

Best Location

Easy access to Timmins – an established mining camp with labour and suppliers.

Clean Hydro Power

Grid power to the Project, draws electricity from Northern Ontario hydro

High-Grade Track- W4

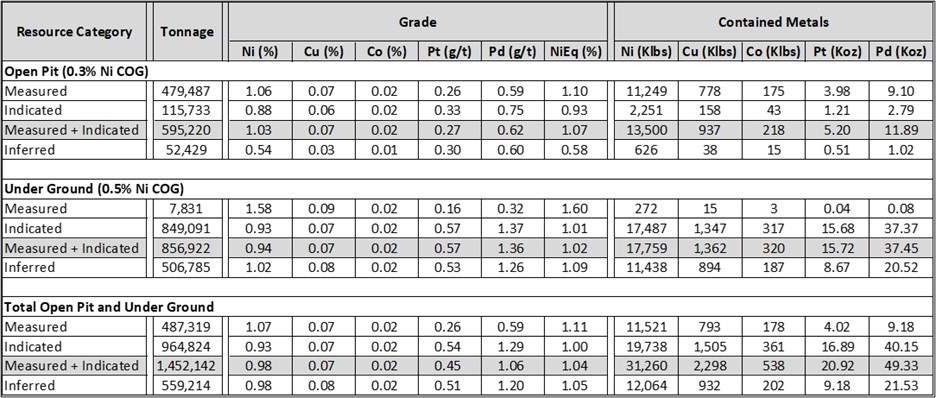

The W4 Nickel Zone was discovered by drilling one of the anomalies in one of the clusters in early 2007 and a 43-101 Resource was reported in 2010 with approximately 15M lbs of Indicated Nickel in the historic estimate, with high-grade 1% Nickel. This was more than doubled with 2022-2023 drilling, and remains open at depth and along plunge. On June 12th, 2023 EVNi reported its Updated Mineral Resource Estimate for W4-

Notes to W4 Updated Mineral Resource Estimate

1. The independent Qualified Person for the MRE, as defined by NI 43-101, is Mr. Simon Mortimer, (FAIG #4083) of Atticus Geoscience Consulting S.A.C., working with Caracle Creek International Consulting Inc. The effective date of the MRE is June 9, 2023.

2. These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this MRE are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

3. The MRE was prepared following the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (November 29, 2019).

4. 3D geological modelling revealed that the mineralization exists as a single steeply dipping continuous unit that have been faulted, thickened, and displaced along five fault surfaces. The estimation has been carried out using “un-faulting” techniques, restoring the mineralization within each fault block to its pre-faulted position, estimating and then returning each block to its present location.

5. Mineralized domains were based on a combination of lithological and structural contacts with internal boundaries based on the distribution of nickel mineralization, utilizing thresholds of 0.2% Ni to define the low-grade domain and 0.5% Ni to define the high-grade.

6. Geological and block models for the MRE used core assays (1,977 samples), data and information from 70 surface diamond drill holes (23 from EVNI and 47 historical). The drill hole database was validated prior to resource estimation and QA/QC checks were made using industry-standard control charts for blanks, core duplicates and commercial certified reference material inserted into assay batches by EV Nickel Inc.

7. Estimates have been rounded to three significant figures for Measured and Indicated categories, and two significant figures for the Inferred classification.

8. The resource estimates have been constrained by a conceptual open pit using the following optimization parameters, as reviewed and agreed to by the QP. Metal prices used were (US$) $8.00/lb nickel, $3.25/lb copper, $13.00/lb cobalt, $900/oz for platinum and $1,200/oz for palladium. An overall pit slope of 50 degrees was used. Mining and processing costs (US$) were based on benchmarking from similar deposit types in the area, utilizing a mining cost of $3.80/t, a processing cost of $45.00/t, a G&A cost of $5.00/t, and a selling cost of $8/lb. All resources below the conceptual pit are considered extractable via underground mining scenarios. A cut-off grade of 0.30% Ni was applied to the resource block model for the portion that could be extracted via open pit mining method and a cut off grade of 0.5% Ni applied to the portion of the block model below the optimized conceptual pit. 9.

The MRE comprises nickel, cobalt, copper, platinum and palladium and considers a calculation of nickel equivalent (“NiEq”), calculated using the metal prices (US$) $8.00/lb nickel, $3.25/lb copper, $13.00/lb cobalt, $900/oz for platinum and $1,200/oz for palladium, and considering recoveries of 85% for nickel, 80% for cobalt, 70% for copper, 50% for platinum, and 50% for palladium.

10. The block model was prepared using Micromine 2020. A 3 m x 3 m x 3 m block model was created, with sub blocks to 1 m x 1 m x 1 m. Drill composites of 1.5 m intervals were generated within the estimation domains, and subsequent grade estimation was carried out for Ni, Cu, Co, Pt and Pd using Ordinary Kriging interpolation method.

11. Grade estimation was validated by comparison of input and output statistics (Nearest Neighbour and Inverse Interpolation methods), swath plot analysis, and by visual inspection of the assay data, block model, and grade shells in cross-sections.

12. Density estimation was carried out for the mineralized domains using the Ordinary Kriging interpolation method, on the basis of 228 specific gravity measurements collected by EVNi during the core logging process and 90 from historical reporting, using the same block model parameters of the grade estimation. As a reference, the average estimated density value within the mineralised domain is 2.82 g/cm3 (t/m3). A Technical Report in support of the MRE will be filed on SEDAR (www.sedar.com) within 45 days of the date of this news release. The MRE is effective as of June 9, 2023. On a Nickel Equivalent basis (“NiEq”), this Measured & Indicated Resources of 31.3M pounds at 0.98% Ni, works out to 33.2M NiEq pounds (2.2x the 2010 historical estimate on a NiEq basis) and the Inferred Resources of 12.1M pounds at 0.98% Ni works out to 12.9M pounds (3.8x the 2010 historical estimate on a NiEq basis).

A Technical Report in support of the MRE will be filed on SEDAR (www.sedar.com) within 45 days of the date of this news release. The MRE is effective as of June 9, 2023.

On a Nickel Equivalent basis (“NiEq”), this Measured & Indicated Resources of 31.3M pounds at 0.98% Ni, works out to 33.2M NiEq pounds (2.2x the 2010 historical estimate on a NiEq basis) and the Inferred Resources of 12.1M pounds at 0.98% Ni works out to 12.9M pounds (3.8x the 2010 historical estimate on a NiEq basis).

Shaw Dome- W4 Deposit Resource Tech Report – PDF

In addition, on W4:

– EVNi initiated permitting in 2022, applying for a Mining Lease

– Metallurgical Testing currently underway with SGS

– Tremendous Synergy Potential with neighbour:

- High-Grade Hart Deposit (3.5km away) and Redstone Mill (7km away)

EVNi closely tracks its “Discovery Cost“- total exploration spend / mineralization discovered.

The Company has had a World-Class Discovery Cost with the Shaw Dome Project.

With W4, prior to EVNi , the previous owners drilled 23,905m. Using our $250/m estimated cost, =$6M spent, for 18M lbs, = 33c / lb.

EVNi drilled 9,168 metres @ $250/m cost, spending $2.3M, and added 25.2M lbs, = less than 1c / lb Discovery Cost.

Based upon past experience, Management know the Sudbury camp targets ~8-10c/lb discovered.

– Sean Samson, President & CEO, Director

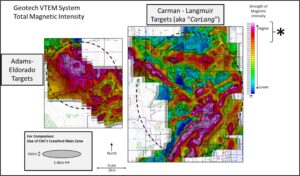

Large-Scale Track- CarLang

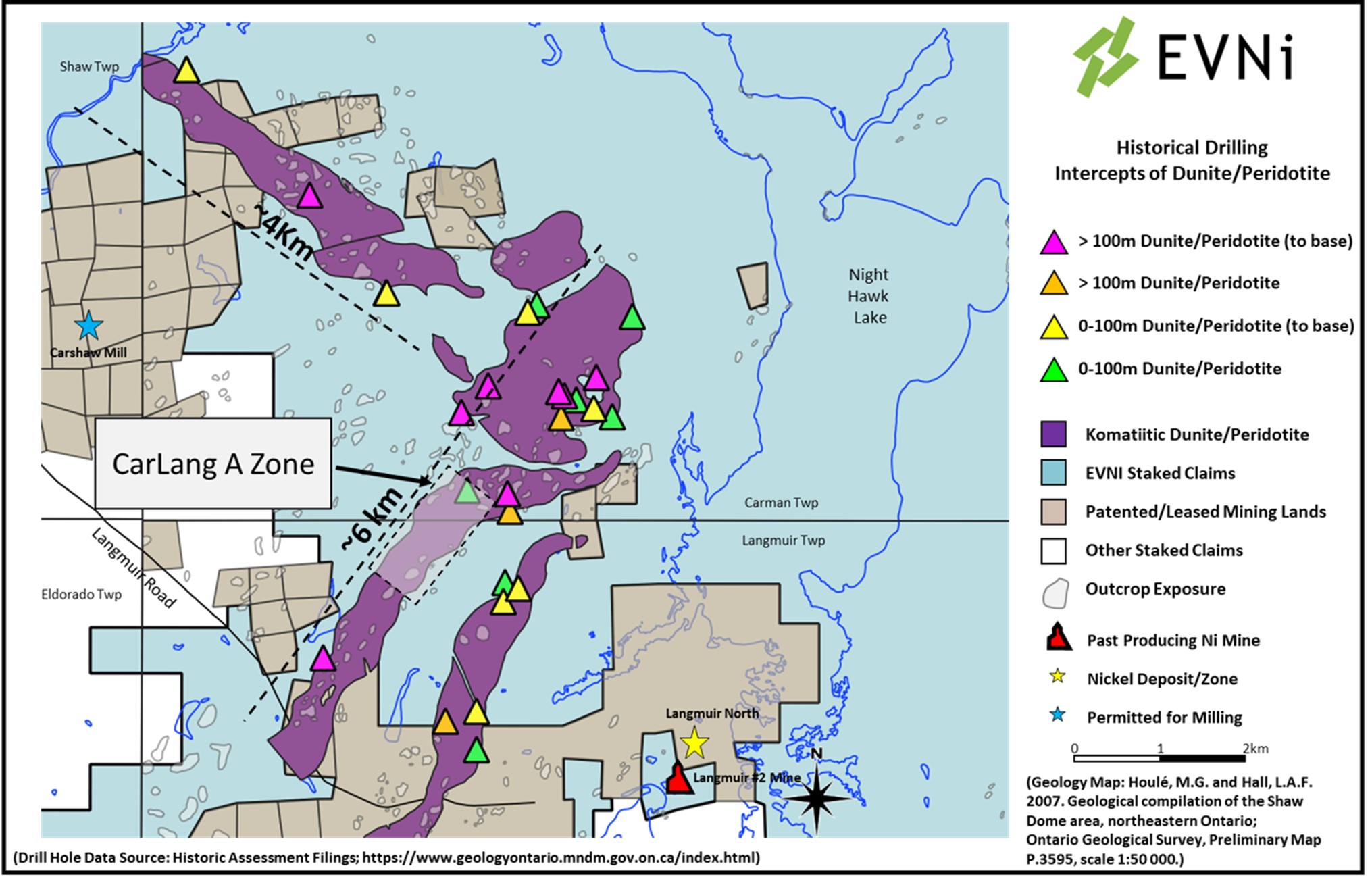

The CarLang Area was initially observed in the Magnetic Intensity surveys flown on the Shaw Dome Project. The CarLang in the northeast (and the Adams-Eldorado targets to the west of the CarLang) had enormous komatiitic dunites and peridotite trends, identified as high magnetic anomalies, interpreted to likely contain elevated nickel contents.

The CarLang Area was the initial Large-Scale focus and EV Nickel aggregated the historic data, showing that through drilling, the trend was identified as being >10km long.

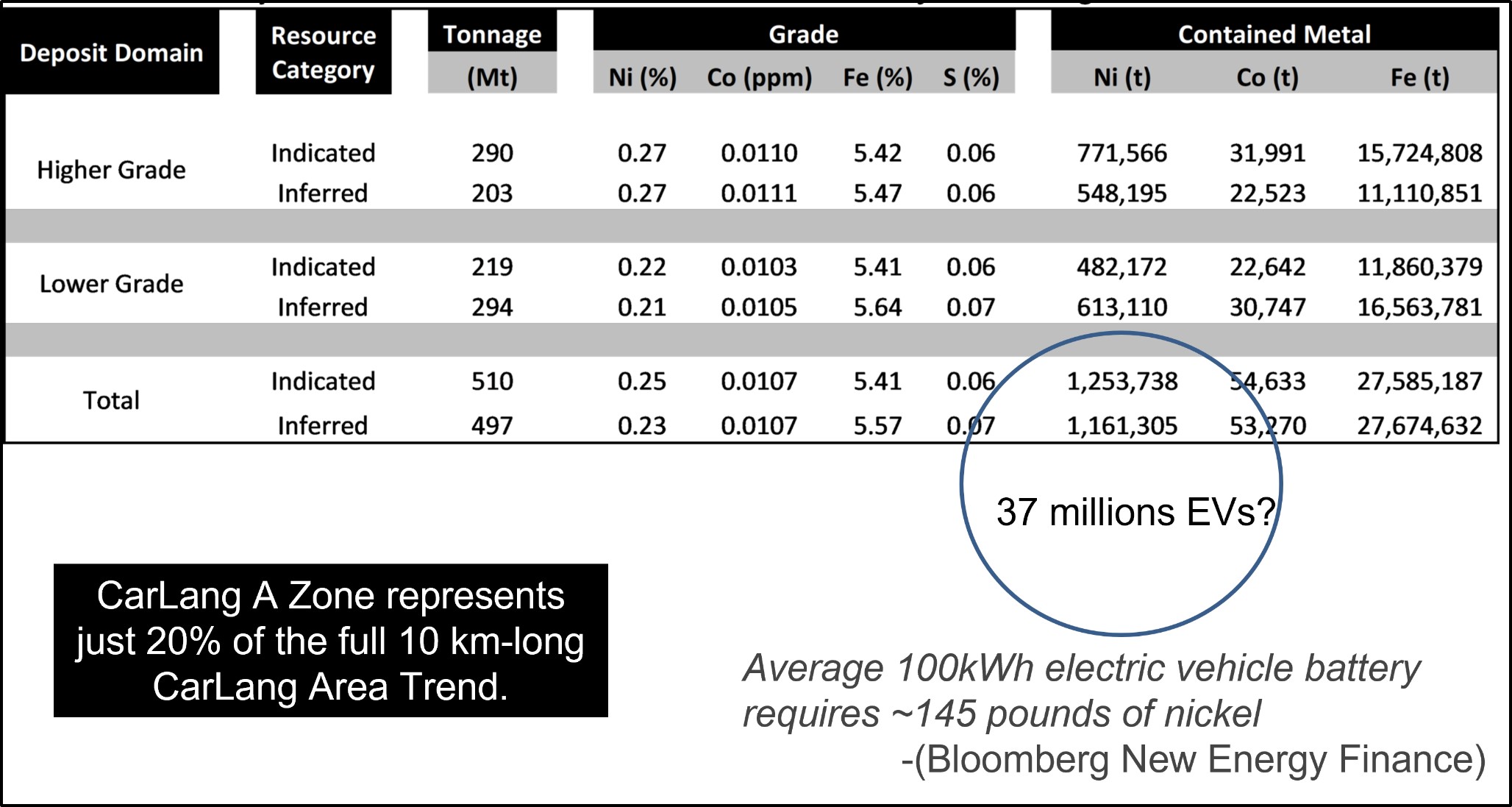

Drilling the A Zone, which is ~20% of the CarLang, identified one of the world’s largest undeveloped nickel deposits.

Notes to CarLang A Zone Maiden Mineral Resource Estimate

1.The independent Qualified Person for the Mineral Resource Estimate, as defined by NI 43-101, is Simon Mortimer (FAIG #4083), of Atticus Geoscience Consulting. The effective date of the Mineral Resource Estimate is February 27, 2023.

2.These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

3.Mineralised domains were based on lithological contacts and a cut-off grade of 0.25% Ni was used to define the high-grade domain. This threshold was determined through analysis of the distribution of nickel grade within the drill core lithologies.

4.Geological and block models for the Mineral Resource Estimate used data from a total of 28 surface drill holes. The drill hole database was validated prior to resource estimation and QA/QC checks were made using industry-standard control charts for blanks, core duplicates and commercial certified reference material inserted into assay batches by EV Nickel.

5.Estimates have been rounded to two significant figures.

6.The mineral resource estimates have been constrained by conceptual pit envelopes using the following optimization parameters. Metal prices used (US$) were $8.00/lb for nickel, and $23/lb for cobalt. An overall pit slope of 45 degrees was used. Mining and processing costs (US$) were based on benchmarking from similar deposit types in the area, utilising a mining cost of $3.50/t, a processing cost of $4.50/t, a G&A cost of $2.50/t, and a selling cost of $0.80/lb.

7.The Mineral Resource Estimate was prepared following the CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (November 29, 2019).

8.The geological model as applied to the Mineral Resource Estimate comprises of a mineralized domain hosted by variably serpentinized ultramafic rocks with a domain of relatively higher-grade material within the core of the unit. Individual wireframes were created for each domain.

9.The block model was prepared using Micromine 2020. A 20 m x 20 m x 15 m block model was created and samples were composited at 7.5 m intervals. Grade estimation from drill hole data was carried out for Ni, Co, Fe, S, using Ordinary and Dual Kriging interpolation method.

10.Grade estimation was validated by comparison of input and output statistics (Nearest Neighbour and Inverse Distance Squared methods), swath plot analysis, and by visual inspection of the assay data, block model, and grade shells in cross-sections.

11.Density estimation was carried out for the mineralized domains using the Ordinary Kriging interpolation method, on the basis of 941 specific gravity measurements collected during the core logging process, using the same block model parameters of the grade estimation. As a reference, the average estimated density value within the higher-grade is 2.68 g/cm3 (t/m3), while low-grade domains of the resource model yielded averages of 2.77 g/cm3 (t/m3).

Shaw Dome- CarLang A Zone Resource Tech Report – PDF

On the CarLang A Zone, EVNi drilled 8,295 metres @ $250/m cost, spending $2.1M, and added 5.3B lbs, = 0.0004c / lb Discovery Cost.